The Net Asset Value is the foundation of evaluating the performance of the investment fund. The Net Asset Value consists of the fund’s total assets minus its total liabilities. In detail: it is the market value of all the owned securities plus any receivable dues to the fund and any amount of cash after deducting any fund commitments. The unit price is calculated by dividing the net asset value on the number of the exported units. Return on Investment in the fund is measured by comparing between the prices of the investment fund’s units at the beginning and the end of the investment period as the following:

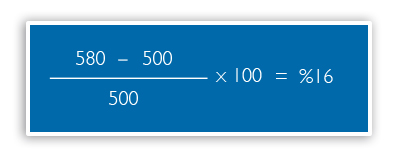

If an investor bought a number of units in (x) fund with the value of 500 riyals per unit at the start of the investment period and sold those units in the value of 580 riyals per unit by the end of the period, then the return on investment by the end of the investing period in the fund is:

The higher the investment fund’s unit value, the higher return on investment in this fund. The performance of the investment funds is affected, as other investment tools, by different factors according to the affected listed securities. This reflects on the fund’s total performance and the value of its units. Managers and workers of these funds work hard to score the highest possible growth rates. After calculating the return on investment to the fund, this return can be evaluated from different aspects. It can be absolute by evaluating the return achieved by the fund in a specific period without comparing it with other financial instruments’ returns or the general index or the sectors index. In addition to evaluating the return through relative comparison OR evaluate it after keeping in mind the level of inherent risk.